Dynamic SR System

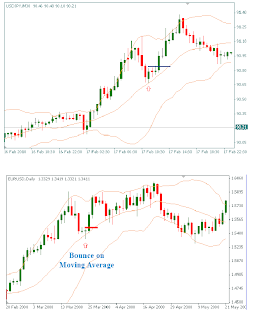

The first trading set-up we are going to show you is the Dynamic SR set-up.

As the name suggests the basis for this system is dynamic support\resistance level which price has struggle to break. When price touches this level we will wait for signs that price is reversing- and will enter the trade.

The dynamic SR level will be the Moving Average level. Preferably the 20- period Moving Average, though you can use any other period.

Step 1: Waiting for the MA to become sloped.

We wait for the MA to become sloped. This is a sign that the trend is strong. A sloped moving average means that the trend is strong and therefore any retracement to the MA will probably lead to a continuation in price, and a good trading signal for us to trade.

Step 2: Wait for price to touch MA.

Wait for price to touch the MA, and reverse. Reversal is confirmed when price goes above the high of the previous candle (for long trades) or below the low of the previous candle (for short trades).

Step 4: Placing Stop Loss.

Stop Loss is placed:

- 5 pips below the lowest low of last 4 candles (for long trades)

- 5 pips above the highest high of last 4 candles (for short trades)

Exiting the Trade.

Trade is closed when the moving average is no longer sloped = is flat.

Examples for trades

1 comments:

As the title indicates the base for this method is powerful support stage which value has struggle to crack. When value touches this stage we will delay for signs that value is treating and will enter the deal.

Forex signals

Post a Comment